A Comprehensive Overview of Check Registers

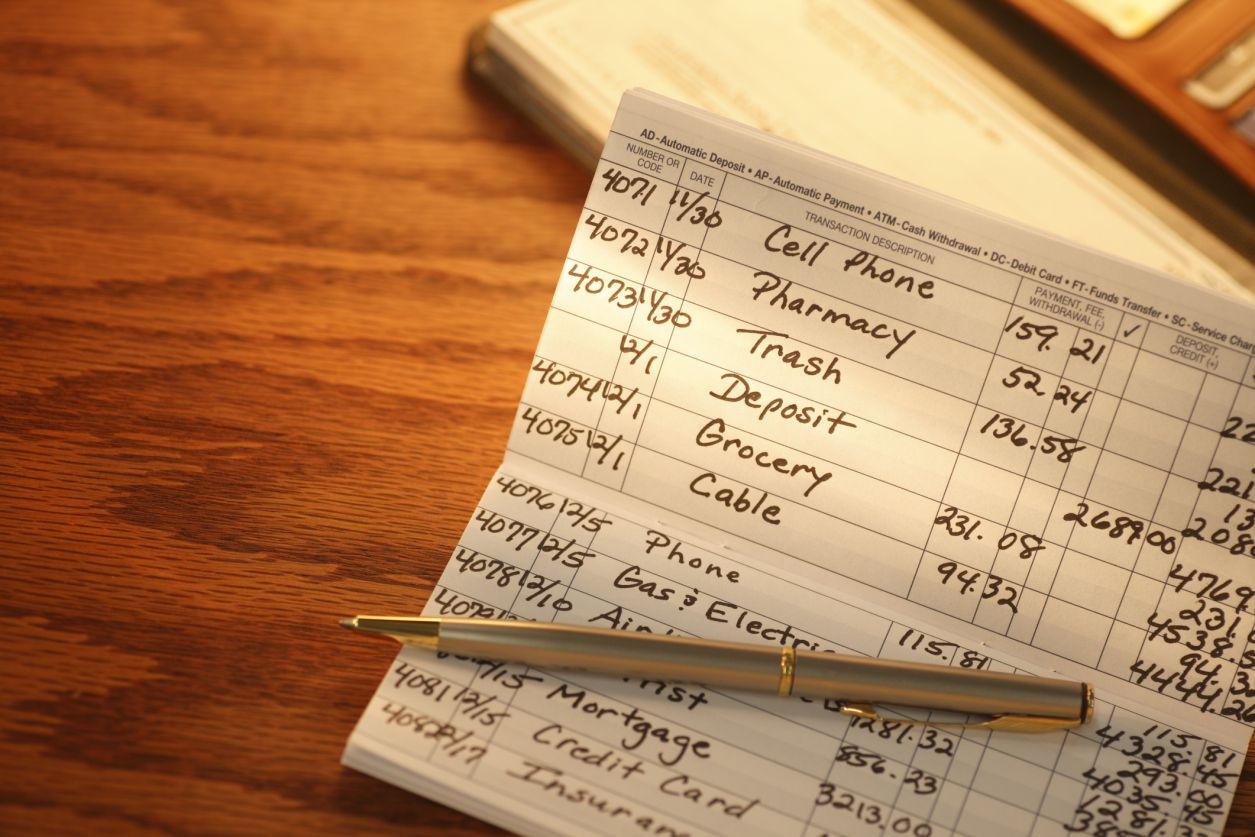

Check registers are essential financial tools that serve as a manual record-keeping system for tracking transactions. They provide a structured format to record and monitor incoming and outgoing funds, making it easier to manage personal or business finances effectively.

Maintaining a Clear Financial Picture

Check registers play a vital role in maintaining a clear and accurate financial picture. By documenting every check written, deposit made, and other financial transaction, individuals can gain a comprehensive overview of their spending, income, and account balances. This enables better financial planning, budgeting, and decision-making.

Tracking Transactions and Balances

One of the primary functions of a check register is to track transactions and balances. Each time a check is written or a deposit is made, the details are recorded in the register, including the date, payee, check number (if applicable), and amount. Balances are continuously updated, ensuring an up-to-date snapshot of available funds.

Detecting Errors and Discrepancies

Check registers serve as a valuable tool for detecting errors and discrepancies in financial records. By regularly reconciling the check register with bank statements, individuals can identify any discrepancies, such as missing transactions or unauthorized charges. This helps prevent fraud, ensures accurate accounting, and maintains financial integrity.

Budgeting and Expense Tracking

Check registers also facilitate effective budgeting and expense tracking. By categorizing transactions and tracking spending patterns, individuals can gain insights into their financial habits and identify areas for improvement. This empowers better budgeting decisions, encourages responsible spending, and promotes financial stability.

How to Start Using a Check Register

To start using a check register, follow these simple steps:

Obtain a check register: Check registers are available at stationery stores, online retailers, or often provided by banks.

Set up the register: Write your name, account number, and opening balance at the top of the register.

Record transactions: Whenever a check is written, a deposit is made, or any other transaction occurs, enter the details in the register, including the date, description, check number (if applicable), and amount.

Calculate balances: Adjust the balance column for each transaction, ensuring it reflects the correct balance after each entry.

Online and Digital Alternatives

In today’s digital age, online and digital alternatives to traditional check registers have emerged. Many banking apps and personal finance software offer digital registers, allowing individuals to track transactions and balances electronically. These digital tools provide convenience, automated calculations, and real-time updates. In addition to online and digital options, individuals can also explore a wide range of check register accessories offered by Carousel Checks, such as checkbook covers and registers with stylish designs, ensuring a personalized and organized approach to financial management.

Conclusion

Check registers are indispensable tools for effective financial management, providing a clear and organized system for tracking transactions, monitoring balances, and promoting responsible spending. By utilizing check registers, individuals can maintain accurate financial records, detect errors, and gain valuable insights into their financial habits. Whether using traditional pen-and-paper registers or digital alternatives, the benefits of check registers in tracking and managing finances cannot be overstated. Embrace the power of check registers and take control of your financial journey with confidence.